Each week, Al Attiyah Foundation publishes its energy market review, bringing you the latest global news from the oil, gas and petrochemicals sector.

Oil registers weekly losses on banking sector chaos

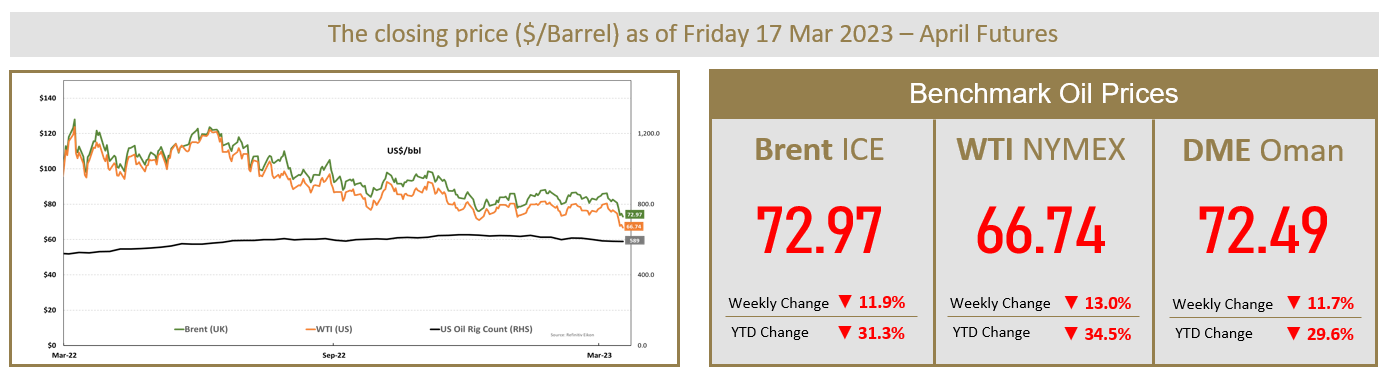

Oil prices settled lower Friday, 17 March, reversing early gains of more than US$1 a barrel as banking sector fears caused both benchmarks to reach their biggest weekly declines in months.

Brent crude futures fell by US$1.73 to US$72.97 a barrel. US West Texas Intermediate crude dropped from US$1.61 to US$66.74. Brent fell nearly by 12% in the week, its biggest weekly fall since December. WTI futures fell 13% since Friday’s close, its biggest since last April.

Oil prices tracked equity markets lower, dogged by the banking sector crisis and worry about a possible recession. All three indexes were sharply lower in afternoon trading, with financial stocks down the most among the major sectors of the S&P 500 following the collapse of Silicon Valley Bank (SVB) and Signature Bank and with trouble at Credit Suisse and First Republic Bank.

Prices had recovered some ground after support measures from the European Central Bank and US lenders but dropped again when SVB Financial Group said it had filed for reorganisation. Analysts still expect constrained global supply to support oil prices in the foreseeable future. OPEC+ members attributed this week’s price weakness to financial drivers rather than any supply and demand imbalance.

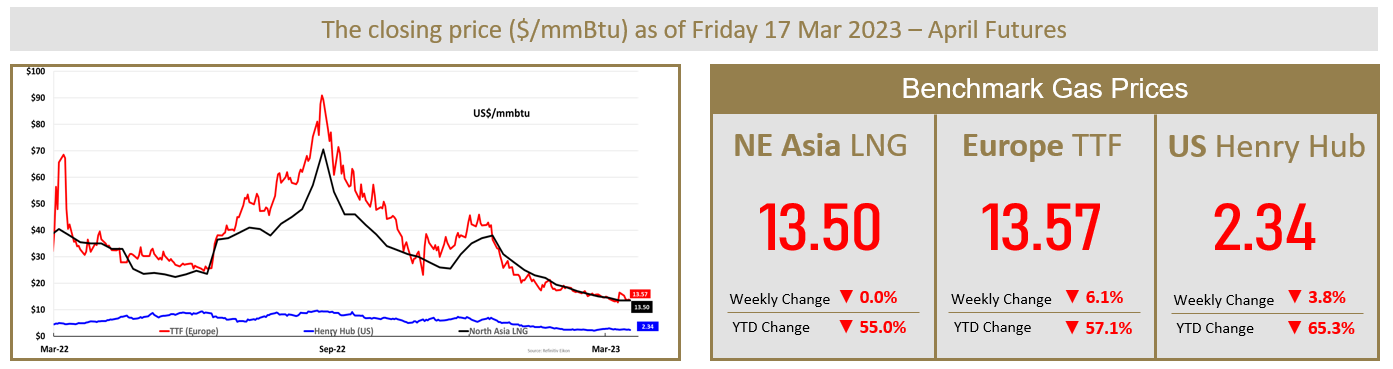

Asian spot prices remain flat, held by buying interest

Asian spot prices of liquefied natural gas (LNG) stayed flat last week, breaking a losing streak of declines since mid-December, as buying interest kept prices from sliding further.

The average LNG price was US$13.50 per mmBtu, the same as the previous week. Prices are now down 81% from their record-high August 2022 levels and have shed over 50% so far this year, incentivising demand from China and price-sensitive markets like Bangladesh and India.

While Asian demand isn’t quite there to sustain bullish momentum, prices may have found a floor on the shoulder months – low-teens is expected now through to the third quarter, according to analysts.

In Europe, gas prices declined on Friday as healthy supply and lower demand helped to offset concerns over strikes in France against the government’s planned pension reform, which had entered a second week.

The three LNG terminals operated by Engie subsidiary Elengy are expected to remain blocked until Tuesday, 21 March, while at least seven LNG ships heading to France have changed course since the strike started. Also in Europe, gas consumption for power generation has begun to pick up, with TTF trading at the low end of the coal-to-gas switching range.

For related reports and other publications, visit abhafoundation.org.

Check out Marhaba’s FREE e-Guides for everything you need to know about Qatar.