Each week, Al Attiyah Foundation publishes its energy market review, bringing you the latest global news from the oil, gas and petrochemicals sector.

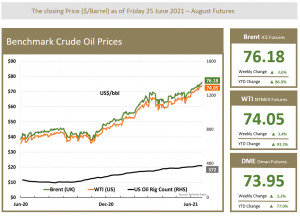

Oil Rises to Highest Since 2018 on Strong Demand

Oil prices climbed to their highest since October 2018 on Friday 25 June, raising both benchmarks for a fifth week in a row on expectations demand growth will outstrip supply, and OPEC+ will be cautious in returning more crude to the market from August. Brent futures rose 0.8% on Friday to settle at USD76.18 a barrel, while US WTI crude rose 1.0% to USD74.05, putting both contracts up over 3% for the week.

Markets wait in keen anticipation for the OPEC countries, Russia and allies, together called OPEC+, who are meeting on 1 July to discuss further easing of their output cuts from August. Most analysts feel the producer group has ample space to boost supply without derailing the drawdown in oil stocks, given the greatly improved demand outlook. The key factor OPEC+ will have to consider is strong growth in the US, Europe and China, bolstered by vaccine rollouts and economies reopening, although countered by rising COVID cases and outbreaks in other places.

The prospect of sanctions on Iran being lifted and more of its oil hitting the market anytime soon has dimmed, with a US official saying serious differences remain over a range of issues in relation to Tehran’s compliance with the 2015 nuclear deal. The lack of an interim agreement between the UN nuclear watchdog and Iran on the monitoring of atomic activities is a serious concern that has been communicated to Tehran, US Secretary of State Antony Blinken said on Friday.

Meanwhile, the number of US oil rigs, an early indicator of future output, rose last week by one to 372, according to energy services firm Baker Hughes Co. Despite the small decline, the rig count gained 13 in June, its 10th monthly rise, and increased 48 in the second quarter, its third consecutive quarterly rise.

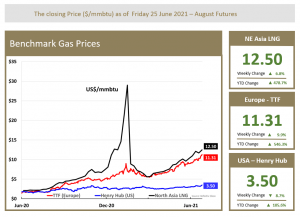

Asian LNG Spot Prices Rise on Air-Conditioning Demand

Asian spot prices for liquefied natural gas (LNG) rose last week, on firm demand for the power generating fuel, as a warmer than usual summer in different parts of Asia boosted electricity usage for air-conditioning. The average LNG price for August delivery into Northeast Asia was estimated at about USD12.50 per mn British thermal units (mmBtu), up USD0.80 from the previous week. Temperatures in Beijing, Tokyo, Seoul, and Shanghai are expected to be higher than average over the next two weeks, weather data from Refinitiv Eikon showed, which could reduce inventories and increase gas demand for cooling.

In the US, forecasts for hotter weather over the next two weeks also helped push natural gas futures to a 29-month high, at a time of smaller-than-expected storage build and rising exports. Traders noted prices were up even though the weather was expected to turn milder in two weeks, which should cut air conditioning demand.

On their second to last day as the front-month, gas futures for July delivery rose 2.3%, to settle at USD3.50 per mmBtu, their highest close since January 2019 for a second day in a row. The August futures, which will soon be the front-month, were up about 7 cents to USD3.51 per mmBtu. For the week, the front-month was up over 8%, its largest weekly increase since early February. Last week, the contract slid over 2%.

In Europe, gas storage has been reported to be below a five year average, increasing demand for restocking, pushing prices up nearly 10% on the week. Disruptions on the supply side also kept the market tight. Russian producer Sakhalin Energy said it plans to stop output for about a month, starting in July, to carry out maintenance. As a result, competition between Asian and European buyers for cargoes has increased, with Asian buyers paying over benchmark prices to secure deliveries. Taiwan surprised the market last week by seeking a 10-cargo purchase for delivery between August and December and offers due on 28 June. BP also offered USD0.10 over the Platts benchmark for a cargo for August delivery to Tianjin, China.

For more reports and other publications, visit abhafoundation.org

Read more about the Oil, Gas and Petrochemical industry in Marhaba’s FREE e-Guides

Like and follow Marhaba’s social media accounts for the latest updates and content:

Facebook: Marhaba Guide Qatar

Instagram: @marhabaguideqatar

Twitter: @MarhabaQatar

LinkedIn: MarhabaInformationGuide

YouTube: MarhabaQatar