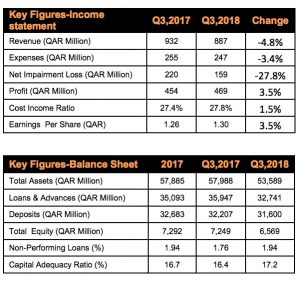

Al Khalij Commercial Bank (al khaliji) PQSC, announced a net profit of QAR469 million for the third quarter of 2018, a result of effectively managing margins, controlling costs and reducing impairments.

HE Sheikh Hamad Bin Faisal Bin Thani Al Thani, Chairman and Managing Director of al khaliji, said the bank has consistently delivered growth in profitability, maintaining focus on Qatar-centric medium term strategy.

These results reflect our commitment to the strategy, which is being delivered on the foundation of a strong capital base and excellent liquidity. We are proud of Qatar’s progress during this year, and we are well positioned to capitalise on its growth in the future.’

Speaking on the third quarter 2018 performance, Fahad Al Khalifa, CEO of al khaliji Group, said that the positive results embody selective growth, continued focus on the domestic market, and effective management of cost base.

Staying close to our clients and tailoring our business to meet their requirements remain at the heart of delivering our strategy. I am proud to note that this has been recognised.’

al khaliji recently received the ‘Best in Customer Satisfaction’ award from Qatar Development Bank and the ‘Best Private Banking Services in MENA’ and the ‘Best Corporate Bank in Qatar’ from a European magazine. The bank continues to focus on maintaining an efficient cost base, and consistent with earlier quarters, the costs are 3.4% lower year on year, according to Al Khalifa.

We remain focused on credit quality across the group, and we continue to remain prudent in our provisioning. That said, we have reduced overall impairment charges by 28% year on year.’

Khalifa said that as Qatar’s economy continues to grow, including in the non-hydrocarbon sector, they are well positioned to benefit from increased business with clients in the wholesale banking and private banking franchises.

For updates and more information about al khaliji, visit alkhaliji.com.