Each week, Al Attiyah Foundation publishes its weekly energy market review, bringing you the latest global news from the oil, gas and petrochemical sector.

Oil Markets

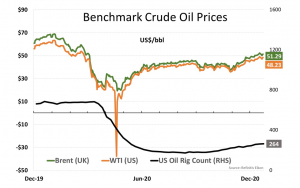

Oil prices inched higher on Thursday 24 December, helped by late-day buying in a low-volume session to close out the week. The market-built gains on Wednesday night, as Britain and the European Union reached a post-Brexit trade deal, reversed those gains, and then rebounded during the US session to end modestly higher. US West Texas Intermediate (WTI) crude settled to USD48.23 a barrel, while Brent crude futures settled at USD51.29. Volumes were light on the last trading day before the Christmas holiday, as both benchmarks slipped. For the week, US crude fell 1.6% while Brent lost 2%.

Markets have rallied sharply since late October, as vaccines progressed to approval in numerous countries. Worldwide, infections are growing, and the pandemic will cloud investors’ outlook for several more months. While the Brexit deal supported the market last week, the impact of COVID-19 is the dominant driver as the market waits for the wider distribution of vaccines.

New strains of the coronavirus, which appear to spread the disease more rapidly, have now hit some countries. However, at least four drug-makers expect their COVID-19 vaccines to be effective against the new fast-spreading variant of the virus that is raging in the UK and are performing tests that should provide confirmation in a few weeks.

By clinching a Brexit deal, the UK avoids a chaotic departure from one of the world’s biggest trading blocs, a move many investors warned would have sparked further volatility in financial markets. Markets also seemed to have shrugged off President Donald Trump’s criticism of the fiscal relief package earlier approved in Congress, which may put the bill in limbo. Republicans and Democrats in the US House of Representatives on 24 December blocked attempts to alter the USD2.3 tn coronavirus aid spending package.

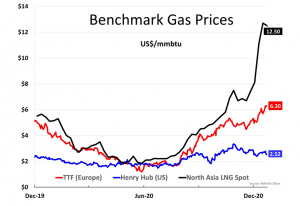

Asian spot prices for LNG last week remained at the highest in more than six years, with growing shipping rates adding to a supply crunch and high demand for heating. The average LNG price for February delivery into Northeast Asia was estimated at USD12.50 per mn British thermal units (mmBtu), up USD1.30 from the previous week. Winter in Asia continued to drive strong demand for heating gas, with temperatures in Beijing, Tokyo, Shanghai, and Seoul set to be lower than average over the next two weeks.

According to traders, supply shortages in Malaysia, Indonesia, Norway, Nigeria, and Qatar are making China, the world’s second-largest importer of the super-chilled fuel, turn to supply from the US. The amount of US gas flowing to export plants are as a result at record levels. Local gas pipeline prices below USD3 per mmBtu make the conversion to liquid profitable and improves prospects for new projects in 2021. However, congestion in the Panama Canal, through which US LNG usually finds a shorter route to Asia, is helping to push freight rates up.

Since May, spot LNG prices in Asia have soared sevenfold, when lockdowns hit gas demand from industries. European prices also gained last week: Title Transfer Facility (TTF) gained over 10% closing at USD6.30, as firmer consumption and lower supply outlook of Russian gas supported a rally in prices.

For more reports and other publications, visit abhafoundation.org

For more reports and other publications, visit abhafoundation.org