Each week, Al Attiyah Foundation publishes its energy market review, bringing you the latest global news from the oil, gas and petrochemicals sector.

Oil prices rise as US closes in on debt deal

Oil prices ticked up on Friday, 26 May, as US officials appeared close to striking a debt-ceiling deal, and as the market weighed conflicting messages on supply from Russia and Saudi Arabia ahead of the next OPEC+ policy meeting.

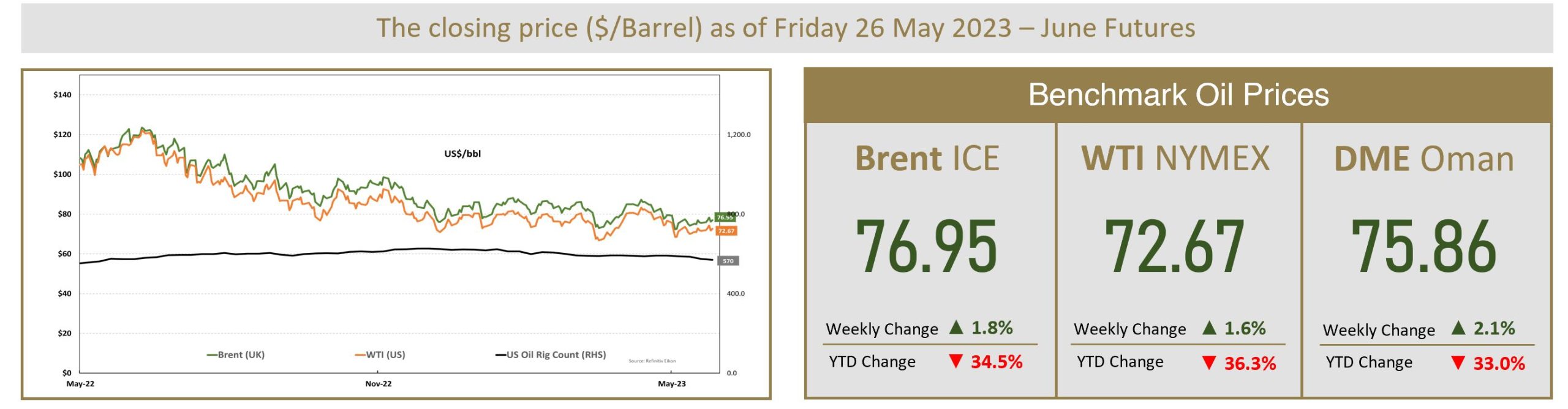

Brent crude settled at 69 cents, or 0.9%, higher at US$76.95 a barrel. US WTI closed up 84 cents, or 1.2%, at US$72.67 a barrel. On a weekly basis, both benchmarks posted a second week of gains with Brent climbing 1.8%, while WTI rose 1.6%. Still, markets remained cautious as debt talks may drag on and there are fresh worries about a Federal Reserve interest rate hike next month that would curb demand after strong US consumer spending data and inflation readings.

While it is possible negotiators will reach a deal to raise the US government’s US$31.4 trillion debt ceiling, talks could easily spill over into the weekend, according to a Biden administration official.

Meanwhile, Russian Deputy Prime Minister Alexander Novak played down the prospect of further OPEC+ production cuts at its meeting in Vienna on 4 June. Russia was leaning towards leaving oil production volumes unchanged because Moscow is content with current prices and output, sources told Reuters.

Asian spot LNG prices slide on low demand

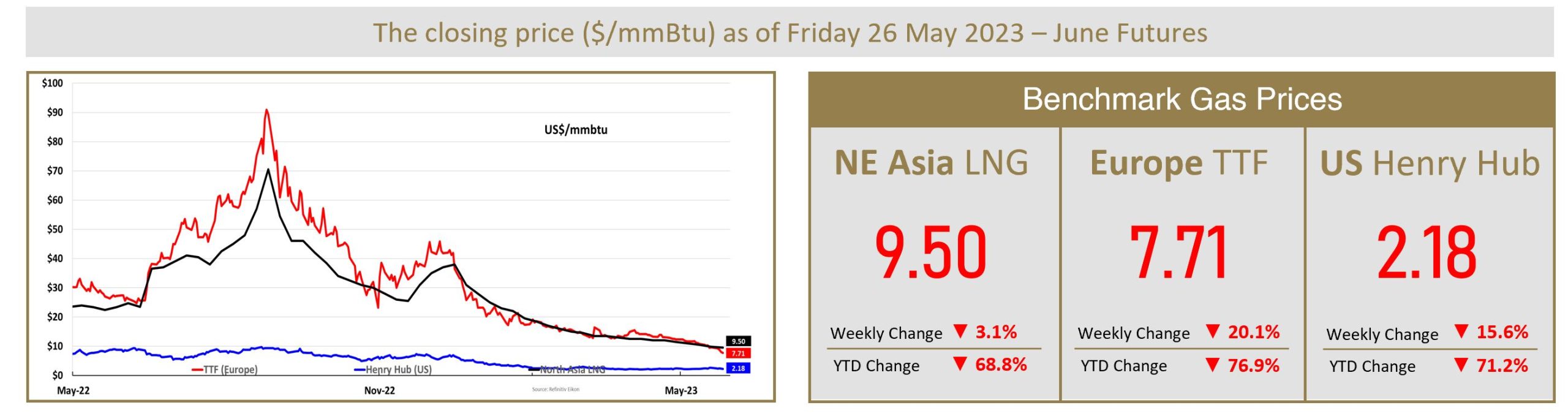

Asian spot prices for liquefied natural gas (LNG) weakened for the fifth consecutive week on muted demand due to healthy stocks, remaining at their lowest level in two years.

The average LNG price for July delivery into north east Asia was down 3% from the previous week at US$9.50 per million British thermal units (mmBtu), the lowest since early May 2021, following industry sources estimates. To add to this, an Indian tender managed to break the US$9.00 mark and will act as an anchor in the near term in the absence of supply disruptions or any real demand.

Analysts said that prices at US$9-10 per mmBtu are likely to encourage some increased buying from Asia, particularly for power generation, although spot LNG remains expensive for many industrial users.

In Europe, the Dutch benchmark gas price touched its lowest level in two years, as prices across the energy complex fell in response to news that Germany has slipped into recession, amidst mild temperatures and healthy supply.

Gas storage, meanwhile, was around 66% full, versus around 44% a year ago, and with the help of milder weather, buying interest remains low. The front-month contract at the Dutch TTF settled at US$7.71 per mmBtu.

For related reports and other publications, visit abhafoundation.org.

Check out Marhaba’s FREE e-Guides for everything you need to know about Qatar.